Are You Using the Right Business Structure?

The business entity you choose has a great impact on your taxes and liability. Choose wisely.

There’s so much you may be required to do when you launch a business. You might have to register your new company with your state and apply for permits and licenses. It’s likely you’ll need an Employer Identification Number (EIN), a unique nine-digit number that will be required to open a business bank account and might be needed to file your income taxes (though you may be able to use your Social Security Number).

You’ll need to determine early on how you’re going to track your income and expenses so you’ll be able to prepare reports and file your taxes accurately. It’s possible you’ll need to consult with legal and/or financial professionals to make sure you’re doing everything right and haven’t neglected an important step.

How you calculate your income taxes will depend in part on the business structure (or business entity) you’ve selected, like sole proprietor or LLC. Not only does that designation affect the tax forms you’ll file, but it also has an impact on how much personal liability you’re taking on. We’ll look at the differences between them here.

Sole Proprietorship

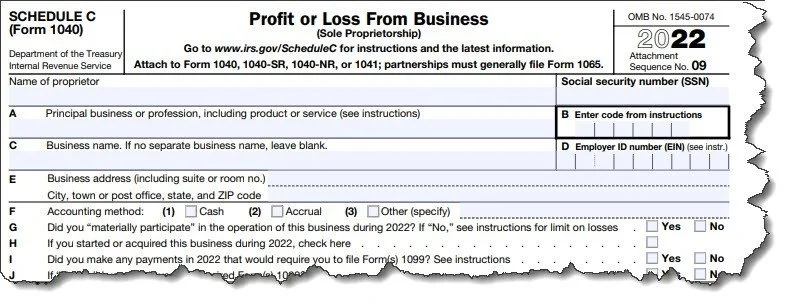

If you own an unincorporated business by yourself, you’re a sole proprietor. You’ll file an IRS Form 1040 or 1040-SR and a Schedule C (Profit or Loss from Business), as well as any other forms and schedules required. This is the simplest business structure and isn’t subject to all of the tax obligations and government regulations that others are. You’ll be taxed as an individual since you and your company are considered the same entity legally. This also means that you are personally responsible for any liabilities or losses.

Sole proprietors file a Form 1040 or 1040-SR and a Schedule C, in addition to any other needed forms and schedules.

Partnership

A partnership is composed of two or more individuals who engage in a trade or business together. Each contributes his or her skills and labor, money, and/or property. All parties share the company’s profits or losses. A partnership is what’s called a pass-through entity. That is, it does not pay income tax. Rather, profits and losses are passed through to the partners, who report them on their personal tax returns.

Partnerships must file an annual information return, where they report their income, gains or losses, credits, deductions, etc. This is the IRS Form 1065, U.S. Return of Partnership Income. Since partners are not considered employees, they do not receive W-2s. But they’re required to file a Schedule K-1, which the partnership furnishes.

C Corporation

This is more complicated and is generally used by larger companies with numerous employees. We can help you understand if this is the entity you choose. Shareholders contribute money or property in exchange for shares of the corporation’s capital stock, and they pay taxes when dividends are distributed. Because the corporation is considered a separate legal entity and is taxed as such, its shareholders are not subject to personal liability.

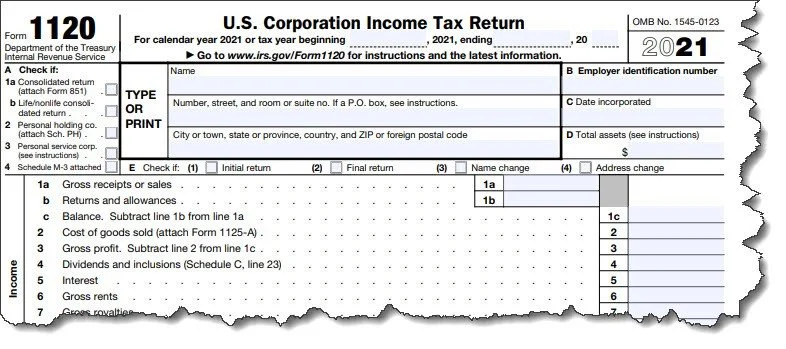

C Corporations file a Form 1120, U.S. Corporation Income Tax Return, and a Form 1120-W, Estimated Tax for Corporations, in addition to other forms and schedules required. This type of entity has complex administrative requirements.

Corporations must file an IRS Form 1120 or 1120-S, along with other forms and schedules.

S Corporation

S Corporations must be domestic operations and have no more than 100 shareholders and one class of stock, among other requirements. They’re another kind of pass-through entity, passing corporate income, losses, credits, and deductions through to their shareholders for tax purposes. Shareholders report this pass-through income and losses on their personal tax returns and pay the assessed tax at their own individual income tax rates.

S Corporations must file Forms 1120-S, Schedule K-1, and Form 1120-W (estimated tax for corporations).

Limited Liability Company (LLC)

Sole proprietorships and other business entities can be legally structured an LLC, which have different regulations depending on what state you’re in. Owners of an LLC are referred to as “members”, and they can be individuals, other LLCs, foreign entities, or corporations. However, some types of businesses, like banks and insurance companies, cannot be members. Membership is unlimited, meaning there can be many members. The IRS considers an LLC as a partnership (if more than one member), a corporation (if electing S Corporation tax status), or as part of the LLC’s owner’s personal tax return (a “disregarded entity”). If an entity doesn’t want to accept its IRS-given default classification, or simply wants to change that classification, it must file a Form 8832 Entity Classification Election and file the proper tax forms.

Understand Your Obligations

Before you select a business entity for the first time, or if you’re planning to change an existing one, please make sure you understand the relevant income tax and legal liability issues. Pathway CPA Group provides all clients with proper guidance about the tax implications so you don’t make an unfortunate choice. Since we are not attorneys, we will gladly refer you to a qualified business attorney to help consider the legal aspects of your chosen business entity.

CPA + Attorney = Wise Entity Decision