Should You Consider Claiming the Home Office Deduction?

Working from home has become much more commonplace in recent years. Does your home office qualify for a tax deduction?

Some industry insiders say that the COVID-19 pandemic accelerated the practice of working from home by about 10 years. That is, we were already headed in that direction, but home offices became a necessity for many when a substantial number of offices shut down completely in 2020. A lot of W-2 employees were ready for this because they’d already been using existing technology to do part of their work-related tasks from home.

You’d think that those workers would be allowed a tax deduction for that forced relocation. But they’re not. Because of the Tax Cuts and Jobs Act of 2017, you can no longer deduct unreimbursed employee expenses on your federal return (though your states may still allow some of this).

So who does qualify for the Business Use of Your Home deduction? And what can they claim as related expenses on their tax returns? Are there any exceptions? We’ll look at the IRS’ rules.

Principal Place of Business

You probably already know the answer to the first question. It’s primarily self-employed individuals who can claim home office-related expenses. To qualify, the portion of your home that you use for your business must be used “exclusively and regularly as your principal place of business.” This can be a room in your house or apartment or a separate structure, but you must not also be using it for any personal purposes.

So if you’re an attorney who writes legal briefs and does other business-related work in your home office but your family occasionally comes in and uses the space for recreational activities, you can’t deduct your expenses for the space.

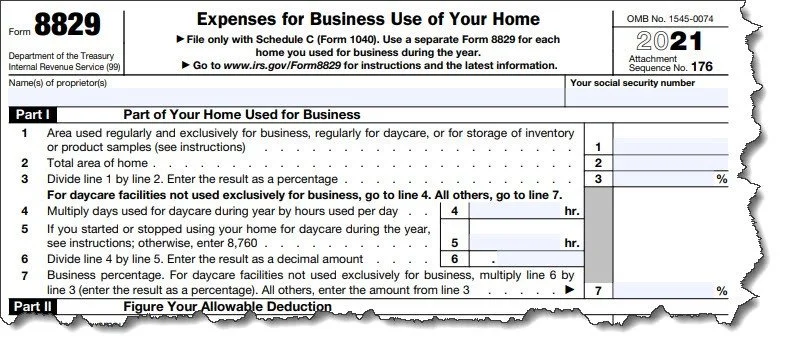

To claim the home office deduction, you’ll need to file an IRS Form 8829 along with your Schedule C.

There are a couple other types of home spaces that might qualify for the home office deduction, including storage for certain types of inventory or product samples, and day care facilities.

Two Approaches

There are two ways you can determine how much of a deduction you can claim. You can change methods from year to year.

The Simplified Method. To calculate this, you’ll need to know:

The square footage of your home office area

The gross income you received from conducting your business at home

The total of your unrelated business expenses

You’d multiply the allowable area by $5, then subtract your unrelated business expenses from your gross income. The smaller amount of these two is your deduction. You will not be able to claim a deduction if these expenses are greater than the gross income from the business use of your home.

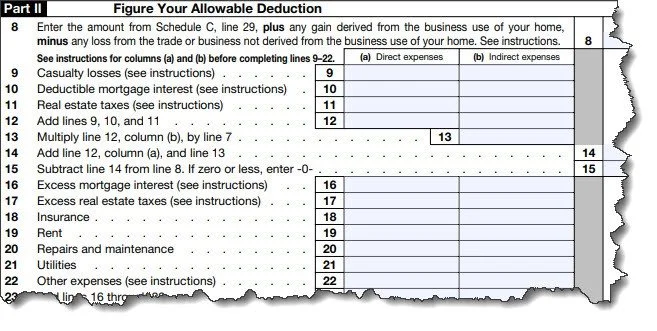

Actual Expenses. Obviously, this will take much more work. You’ll need to know the percentage of your home’s total square footage that is used exclusively for business. The IRS divides expenses into three categories: direct (deductible in full), indirect (only deductible for the percentage of your home used exclusively for business), or unrelated (not deductible).

Whichever method you choose, be sure to keep detailed, comprehensive records. The home office deduction is one of those things that can be a red flag for the IRS and may trigger an audit.

What Can You Deduct?

Determining your home office deduction is much more complicated if you use the Actual Expenses method.

Many of the expenses that are deductible for business use of your home are percentages of the totals that you would enter on your Schedule A, like real estate taxes, home mortgage interest, mortgage insurance premiums, and casualty losses attributable to a federal-declared disaster. Others that are eligible (again, only the percentage of the home used for business) include:

Depreciation (this is complicated)

Insurance

Rent

Repairs

Utilities and services

Not Set in Stone Yet

Keep in mind that the tax code for the 2022 tax year will not be finalized until Congress finishes its work in December. So keep an ear on the news for any income tax legislation that might pass.

Also, remember that the IRS has at least as many exceptions to rules as it has rules. If you think you may be eligible for one of those exceptions, or if you simply have questions about your eligibility or the deductibility of specific expenses, please contact us. We’ll be happy to help clarify the issues for you.